Pinbar Forex Trading System — a popular strategy for entering and exiting positions that is based on the particular candlestick pattern and the following price action. The Pinbar (also known as

"Pin-bar" or

"Pin bar") pattern was first introduced by Martin Pring in his Pring on Price Patterns.

Features

- Conservative strategy offers low-risk high-yield opportunities.

- No-loss rate is pretty high if break-even is applied.

- Rare occurrence.

- Timing is critical.

- Support/resistance is difficult to formalize.

Strategy Set-Up

Any currency pair and timeframe should work, but longer-term timeframes (such as H4, D1 and W1) should work better.

Pinbar Set-Ups:

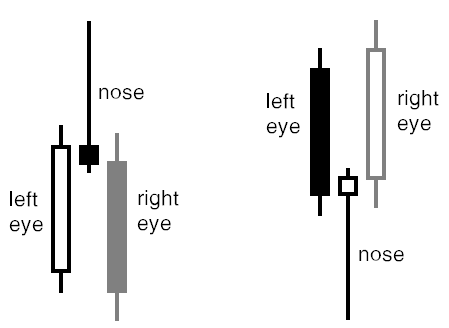

The pattern consists of three bars: the left eye, the nose and the right eye. The left eye should be a bar up for the bearish Pinbar pattern or a bar down for the bullish pattern. The nose bar should open and close inside the left eye, but its high (or low, for the bullish set-up) should protrude much farther than the left eye's high (or low). Both the nose bar's open and close should be located in the bottom (top, for the bullish set-up) 1/4 of the bar. The right eye is where the trading happens.

An additional condition for the good pattern set-up is the strong support/resistance level formed either behind the eyes or near the point of the nose. The stronger are the support/resistance levels you incorporate into this pattern, the more accurate it will be.

You can use the MetaTrader Pinbar Detector indicator to automate the Pinbar pattern detection.

Entry Conditions

Aggressive entry option is to enter a position when in the right eye price retreats behind the left eye's close level.

Conservative entry point is below (above for bullish set-up) the nose bar.

Exit Conditions

Conservative stop-loss can be set behind the nearest support/resistance level behind the eyes. A less conservative approach would be to set stop-loss to immediately behind the nose bar point (in this case, your reward/risk ratio may suffer).

Conservative take-profit can be set immediately after the left eye low (high for the bullish set-up). Aggressive take-profit level may be placed farther — to the next strong support (resistance for bullish positions) level.

Examples

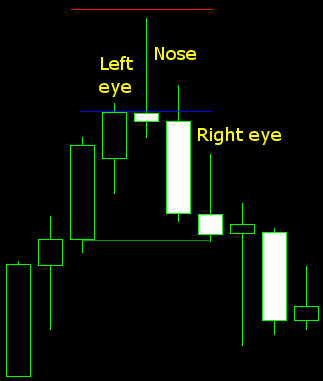

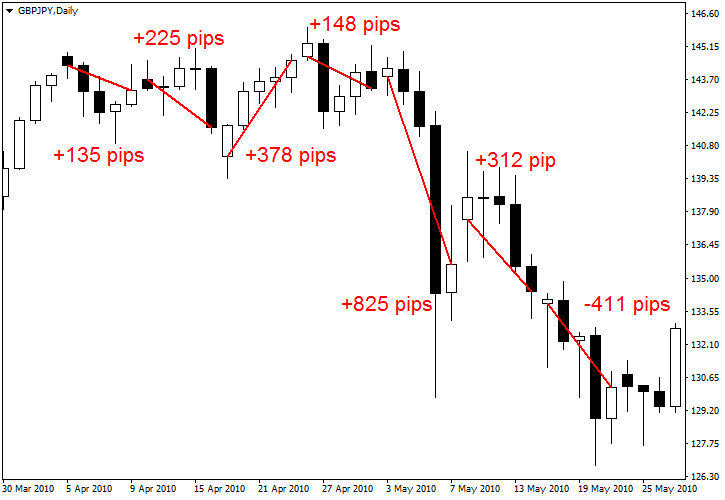

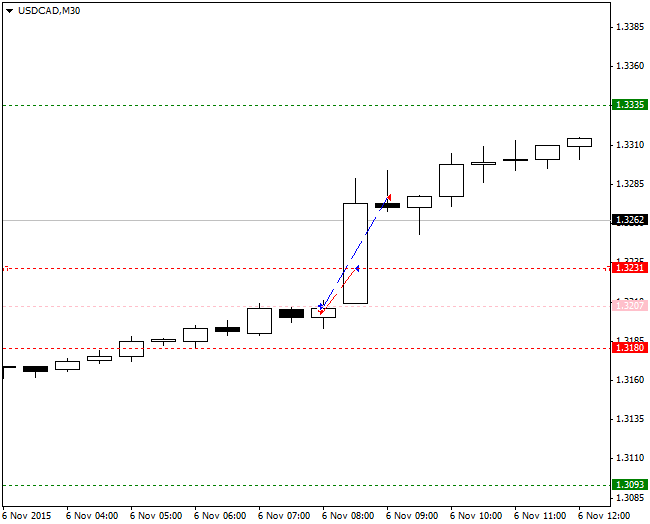

Bearish Pinbar Set-Up:

This is an example of the aggressive set-up. The entry point (blue line) is positioned at the left eye close (price retreated for that entry). Stop-loss (red line) is placed at behind the point of the nose bar (in this situation, even conservative stop-loss wouldn't be hit, as the price pull-back during the right eye happened before the entry). Take-profit (green line) is set at the nearby support level and is easily filled.

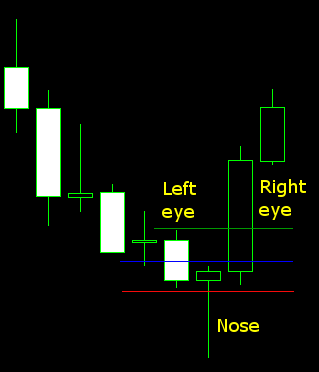

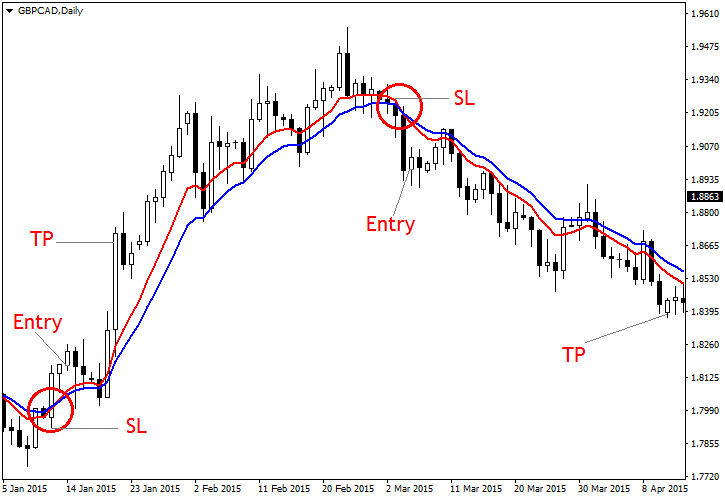

Bullish Pinbar Set-Up:

This is an example of the conservative set-up. The entry point (blue line) is placed just behind the nose bar. Stop-loss (red line) is below the left eye. Take-profit (green line) is just above the left eye.